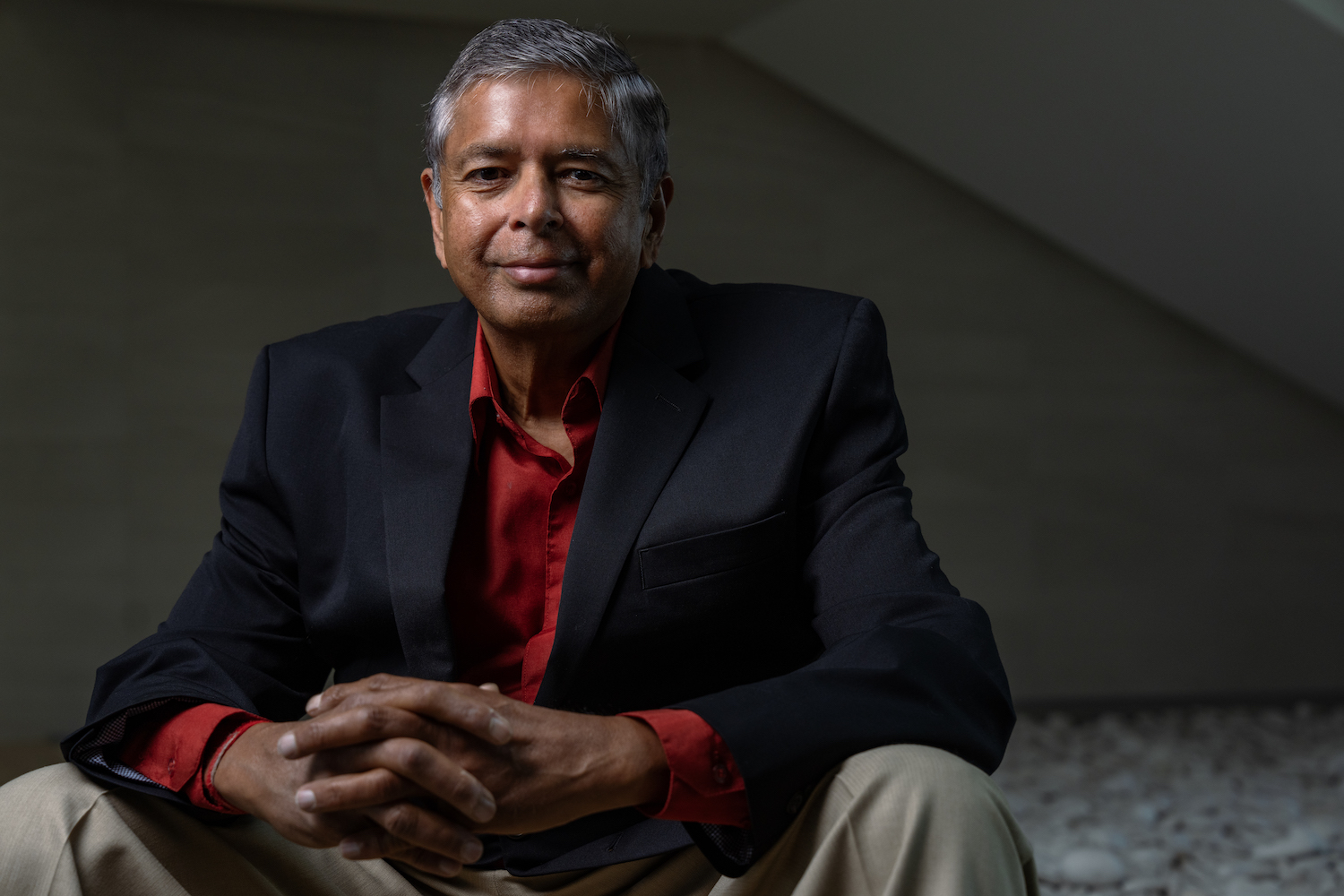

In recognition of April being National Financial Literacy Month, CSUDH Professor of Finance Prakash Dheeriya discusses some of the basic ways that young adults can learn how to manage their money and set realistic goals for themselves.

Dheeriya’s expertise is in personal finance and how to make wise decisions as a consumer, investor, or borrower.

What does it mean for a young adult to be financially literate?

To be financially literate implies that you are not prone to be victims of common financial fraud. It also means that you are able to earn more income without really working at a second job. In other words, you are savvy enough to invest wisely and earn more income passively.

Common skills that one needs to be financially literate include being disciplined enough to pay all of your bills by the due date, thereby avoiding payment of late fees and interest. It also means that you are watching the business environment on a daily basis to identify opportunities for making income in financial markets. Smart shopping or comparison shopping for your daily needs will also help you save money, and therefore, lead to a better financial outcome for you and your family.

How can young adults learn more about personal finance?

The Internet is a good source for learning about personal finance. There are plenty of videos on YouTube, as well as helpful resources on financial trading websites such as Fidelity, tastytrade, E*TRADE, and so on. Khan Academy is another useful website for understanding key financial planning concepts.

What are some common pitfalls for young adults when it comes to personal finance?

Not having discipline is a very common challenge faced by young adults. Retirement seems to be very far away or even unthinkable for young adults, but it should be an important goal in personal finance. Sometimes, young adults are not aware of comparison shopping for key services such as insurance, long term care, and planning for a family.

What are basic financial goals young adults should set for themselves?

Common goals that young adults can set for themselves include planning to buy a house by a certain age, planning to retire by a certain age, achieving a net worth of a certain amount by a certain age, planning for future children, and saving for education.